Coffee Break Loans

Coffee Break Loans is one company that can use this method to get loans ranging from $1 to $5,000. Note that you can get instant credit even if you don’t have good credit. In fact, as the name suggests, it suggests that you can grab it on your “Coffee Break Loans”. But the real truth behind TikTok posts? Can you easily sign up on the website? If you want to know why you should adopt a Coffee Break plan, read on.

Source: Examviews.com

Source: Examviews.com

About Coffee Break Loans

Coffee Break Loans finds loans for you to join. The company itself does not borrow money. Small writers use “financial assistants” or prizes to reward them personally.

Targeting purely individuals and raising funds as a company that is in your position eliminates all other options. The most popular downloads on the Coffee Break Loans website are small personal loans ranging from $1,000 to $5,000.

The repayment period of these loans is usually short – usually 91 days. In the meantime, eligible applicants can request a long-term coffee price refund. Unfortunately, the company does not offer personal loans either. They also offer business loans, car insurance, and credit cards to applicants. If you consult it and recommend it, I hope it is the best choice.

What is a reasonable loan for a Coffee Break?

Coffee Break Loans is a trusted loan finder. But CofraClone is not a lender, it does not evaluate loan applications, approve loans, or perform other functions like financial services companies or banks. Prelojte terms and conditions are not defined or payments are not collected. They are only a loan broker and they only provide your registration online through Private Service Finance Corporation, which reviews your application and decides whether you can lend money or not.

What is a secured coffee break loan?

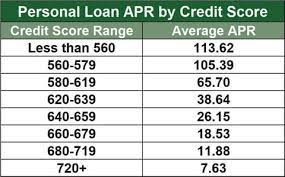

If you decide to apply for a loan with CoffeeBreakloans, the lender is bound to review your details. These are real lenders who will check your income, credit history, and employment status to see if you want to work or not. For these small individual short-term payments, these payments carry interest and interest rates that typically reach 35%.

Now the process is safer – just like it says on the tin: that’s it, the interest rate is higher than a “normal” personal loan. It is advisable to pay a maximum of 30% interest including charges on short-term loans. There is an opinion that the high price of the prize is dangerous. Each state sets the maximum allowable amount of interest a lender can charge. These are different. For fee information, contact your Secretary of State, contact Yalya.